ћногие финансовые контракты содержат встроенные опционы.20 ¬ качестве примеров из области финансов домохоз€йств можно привести право предоплаты, дающее возможность пересмотра выплачиваемого кредитору процента по займу в случае снижени€ процентных ставок в экономике, или же пример с арендой автомобилей, при которой клиент имеет право, но не об€зан, приобрести автомобиль по окончании срока аренды по заранее определенной цене.

—ледует сказать, что метод оценки стоимости опционов используетс€ не только дл€ анализа финансовых инструментов. ѕомимо последних, существует целый р€д так называемых реальных опционов (real options). Ќаиболее используема€ область их при менени€ Ч инвестиционные решени€ фирм. роме того, анализ с помощью реальны опционов примен€етс€ в случае рассмотрени€ инвестиций в недвижимость прин€ти€ решений по вопросам развити€ компаний. ќсновной элемент использо ни€ оценки стоимости опционов здесь тот же, что и в случае рассмотренных вы

20 ћного ссылок по этому вопросу можно найти у R. —. Merton, "Applications of Option- Theory: Twenty-Five Years Later", American Economic Review (June 1998), pp. 323-349, на основе э работы и построен данный раздел.

примеров: неопределенность вариантов будущего развити€. ≈сли бы это было не так не возникло бы и необходимости в создании опционов, поскольку мы в каждый данный момент знали бы, что собираемс€ делать дальше. ѕри наличии измен€ющихс€ факторов внешнего окружени€ предпри€ти€ методика определени€ направлений де€тельности при наступлении того или иного варианта развити€ событий имеет существенную ценность. »менно с этой точки зрени€ теори€ оценки стоимости опционов важна дл€ руководства предпри€ти€.

ќсновные виды опционов, которые используютс€ в рамках решений, касающихс€ оценки стоимости инвестиционных проектов, Ч это опционы по поводу начала или расширени€ де€тельности; опционы по поводу прекращени€ или заключени€ контракта; а также опционы по поводу ожидани€, медленного снижени€ или ускорени€ развити€. —уществуют опционы по поводу роста, которые включают в качестве возможного выбора создание дополнительных мощностей, возможность создани€ новых товаров и даже новых коммерческих предпри€тий, но не налагают об€зательств поступать таким образом в случае, если это оказываетс€ экономически нецелесообразным.

ѕример реальных опционов можно найти в области производства электроэнергии. Ёлектростанцию можно построить с ориентацией на один вид топлива, такой, например, как нефть или природный газ, или же ее можно спроектировать таким образом, чтобы обеспечивалась возможность использовани€ любого из них. ÷енность такого опциона состоит в возможности использовать в каждый данный момент времени то топливо, которое можно приобрести по меньшей цене. Ќо дл€ того, чтобы им воспользоватьс€, необходимо учитывать как более высокую стоимость строительства, так и менее эффективное преобразование энергии, чем в случае применени€ соответствующего специализированного оборудовани€.

ƒругой пример мы находим в индустрии развлечений, он св€зан с прин€тием решени€ о создании продолжени€ какого-либо фильма. ¬ыбор создателей фильма состоит в следующем: либо запускать в производство и сам фильм, и продолжение одновременно, или же подождать и выпустить продолжение после того, как станет известно, имеет ли успех сам фильм. Ќе надо быть специалистом в кинематографии, чтобы догадатьс€, что, если пойти первым путем, затраты на создание продолжени€ окажутс€ меньшими. Ќесмотр€ на это, обычно выбираетс€ втора€ возможность, особенно в случае дорогосто€щих фильмов.

|

|

|

— экономической точки зрени€ причина состоит в том, что второй путь дает возможность выбора (опцион) отказатьс€ от выпуска продолжени€ (если, например, исходный фильм не имеет достаточного успеха). ≈сли же продюсер практически уверен в том, что продолжение будет создаватьс€, то ценность ожидани€ более достоверной информации дл€ прин€ти€ решени€ (стоимость опциона) оказываетс€ незначительной, и затраты на производство в дальнейшем продолжени€ фильма могут оказатьс€ большими, чем доход от него. “аким образом, мы снова видим, что элемент неопределенности оказываетс€ критичным дл€ прин€ти€ решений, а модель оценки стоимости опционов позвол€ет получить количественную оценку затрат и доходов от реализации возможных вариантов.

ѕринимаемое отдельным человеком решение о том, сколько следует уделить внимани€ обучению с отрывом от производства, можно сформулировать как оценку —тоимости опциона в вопросе о том, когда следует закончить подготовку к работе и приступить к ней. ¬ классическом компромиссе между работой и свободным временем человек, имеющий возможность измен€ть количество рабочих часов и, следовательно, заработную плату, обладает существенно более ценным опционом по сравнению с работником, часы работы которого фиксированы. «аработна€ плата, социальное обеспечение и минимальный уровень в планировании пенсии, обеспечивающие 'минимальные выплаты по пособи€м, имеют структуру, подобную опционам.

ћедицинское страхование характеризуетс€ большим разнообразием предлагаемых клиенту вариантов. ќсновной момент здесь состоит в том, соглашаетс€ ли он пользоватьс€ услугами только заранее оговоренных врачей и больниц (по плану Ќћќ\ оставл€ет за собой право выбирать больницу или врача, не вход€щих в эту сир-то"

ч,-,- - ""icmv.

ѕри прин€тии решени€, какой вид страховани€ выбрать, потребитель решает задач об оценке стоимости опциона применительно к ценности возможности выбора. ќчень похожа€ структура оценки возникает в случае выбора (т.е. фактически наличи€ соответствующего опциона) между использованием вариантов с повременной и фиксированной оплатой при пользовании услугами кабельного телевидени€.

—тоимость опциона может составл€ть существенную часть общей стоимости предоставл€емых государством прав на ведение геологоразведочных работ нерезидентами и на использование квот на загр€знение окружающей среды. ћетод анализа стоимости опциона обеспечивает количественную оценку принимаемых правительством решений по экономическим вопросам, например о том, строить ли дороги в регионах с малой плотностью населени€, в свете того, не благоразумнее ли отказатьс€ от развити€ сельских дорог, если они используютс€ недостаточно интенсивно.

— применением модели оценки стоимости опционов рассматривались различные аспекты законодательного характера и налогообложени€, затрагивающие вопросы политики и поведени€ людей в различных ситуаци€х. ним относ€тс€ оценка возможностей (опциона), существующих дл€ истца в судебном процессе. “ак, например, применение законов о банкротстве, включа€ услови€ ограничени€ ответственности, или анализ нарушений налогового законодательства в вопросах, св€занных с недвижимостью и другими видами собственности, предполагает выбор между отчуждением собственности и восстановлением в правах при выплате задолженности.

|

|

|

“еоретические положени€, примен€емые при оценке стоимости опционов, зарекомендовали себ€ в качестве полезного метода в анализе стратегических решений. ¬начале их применение в этой сфере относилось к области энергетики, в которой не только необходимо долгосрочное планирование, но и требуютс€ достаточно масштабные инвестиции, а неопределенность возможных вариантов высока. ѕоскольку энергетика служит основой развити€ любой экономической системы, такое использование теории ценообразовани€ опционов применимо как дл€ развитых, так и дл€ развивающихс€ стран. ¬ некоторых случа€х модели, основанные на теории ценообразовани€ опционов, могут стать стандартными инструментами в стратегическом планировании.

–езюме

Х ќпционы могут использоватьс€ инвесторами дл€ варьировани€ инвестиционных рисков. омбиниру€ безрисковые ценные бумаги с опционами "колл" на акции и индексы, инвестор может выходить на гарантированный минимальный уровень доходности.

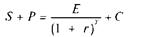

Х ѕортфель ценных бумаг, состо€щий из акций и европейских опционов "пут, эквивалентен комбинации из безрисковой облигации с номинальной стоимостью, равной цене исполнени€ опциона и европейского опциона "колл". “аким образом, в соответствии с законом единой цены, приходим к уравнению паритета опционов "пут" и "колл":

(15.1)

где S Ч курс акций, – Ч цена опциона "пут", г - безрискова€ процентна€ ставка, “ Ч промежуток времени до срока истечени€ опциона, а — Ч цена опциона "колл".

Х Ќа основе акций, лежащих в основе опциона, и безрисковых ценных бума можно сконструировать синтетический опцион. ƒл€ этого необходимо восполь зоватьс€ стратегией динамического дублировани€, обеспечивающей самофинансирование инвестиций после первоначального вложени€. ¬ соответствии с 1Ћ законом единой цены цена опциона определ€етс€ формулой

(15.5)

где

—Ч цена опциона "колл"

S Ч текущий курс подлежащих акций

≈ Ч цена исполнени€ опциона

г Ч безрискова€ процентна€ ставка (непрерывно начисл€ема€ процентна€ ставка (в пересчете на год) дл€ безрисковых ценных бумаг со сроком погашени€, равным сроку истечени€ опциона)

“Ч промежуток времени до срока истечени€ опциона в годах

аЧ риск подлежащей акции, измер€емый стандартным отклонением доходности акции, представленной как непрерывно начисл€емый процент (в пересчете на год)

In Ч натуральный логарифм е Ч основание натурального логарифма (приблизительно 2,71828)

N(d) Ч веро€тность того, что значение нормально распределенной переменной меньше d

ћетодику, аналогичную методике оценки стоимости опционов, можно применить и в других случа€х. ¬о-первых, дл€ оценки стоимости условных требований, св€занных с поступлением доходов от акций и облигаций. ¬о-вторых, дл€ оценки кредитных гарантий. ¬ третьих, дл€ оценки стоимости реальных опционов, содержащихс€ в инвестиционных решени€х в св€зи с проведением научно-исследовательских работ и выбором направлений развити€ технологий производства.

ќсновные термины

Х условное требование (contingent claim), 469

Х опцион "колл" (call), 470

Х опцион "пут" (put), 470

Х цена "страйк" (strike price), 470

Х цена исполнени€ (exercise price), 470

Х дата истечени€ (expiration date), 470

Х американский опцион (American-type option), 470

Х европейский опцион (European-type option), 470

Х биржевые опционы (exchange-traded option), 471

Х внебиржевые опционы (over-the-counter option), 471

|

|

|

Х внутренн€€ стоимость (intrinsic value), 472

Х реальна€ стоимость (tangible value), 472

Х опцион с проигрышем (out of the money), 472

Х опцион с выигрышем (in the money),472

Х опцион без выигрыша (at the money), 472

Х временна€ стоимость, срочна€ преми€ (time value), 472

Х опцион на индекс (index option),472

Х взаиморасчет в денежной форме (cash settlement), 473

Х доходна€ диаграмма (payoff diagram), 474

Х уравнение паритета опционов "пут" и "колл" (put-call parity relation), 479

Х коэффициент хеджировани€ (hedge ratio), 483

Х стратеги€ инвестиционного самофинансировани€ (self-financing investment), 485

Х дерево решений (decision tree), 485

Х биномиальна€ модель оценки стоимости опционов (binomial option-pricing model), 485

Х модель ценообразовани€ опционов Ѕлэка-Ўоулза (Black-Scholes model), 486

Х подразумеваема€ изменчивость (implied volatility), 489

ќтветы на контрольные вопросы

онтрольный вопрос 15.1. »спользу€ таблицу 15.1, рассчитайте внутреннюю и временную стоимость дл€ июньских опционов "колл " на акции компании IBM с ценой исполнени€ 125 долл. Ќайдите соответствующие величины дл€ опционов "пут ".

ќ“¬≈“. ѕоскольку июньский опцион "колл" на акции IBM с ценой исполнени€ 125 долл. €вл€етс€ в данный момент опционом с проигрышем, его внутренн€€ стоимость равна нулю, а временна€ стоимость равна его цене (1 1/2 долл.). »юньский опцион "п;т" на акции IBM с ценой исполнени€ 125 долл. имеет внутреннюю стоимость 4 15/16 долл. (= 125 - 120 1/16).

онтрольный вопрос 15.2. ѕредставьте себе, что 5 июн€ 1998 года вы купили по цене, указанной в табл. 15.2, июньский опцион "колл" на SPX с ценой исполнени€ 1120. „ему будет равна ваша ставка доходности, если величина индекса на дату истечени€, 19 июн€ 1998 года, окажетс€ равной 1200?

ќ“¬≈“.

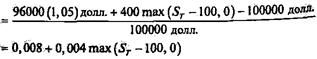

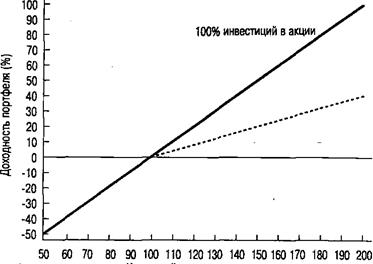

онтрольный вопрос 15.3. „етверта€ стратеги€ состоит в том, чтобы вложить 96000 долл. в безрисковые ценные бумаги и 4000 долл. в опционы. акова минимальна€ гарантированна€ ставка доходности? „ему равен наклон пр€мой на доходной диаграмме справа от точки, соответствующей цене исполнени€?

ќ“¬≈“. ѕри вложении 4000 долл. в опционы "колл" сроком на один год по иене 10 долл. можно купить 400 опционов. ѕолучаемый денежный платеж по опционам будет равен 400х max (St-100, 0). ≈сли опцион истекает без использовани€, вы получите 100800 долл. от своих вложений в безрисковые ценные бумаги. Ёто соответствует ставке доходности в 0,8% годовых дл€ вложенных 100000 долл. Ќаклон идущей вверх части графика на доходной диаграмме равен 0,004. ¬ыражение дл€ обшей доходности вашего портфел€ ценных бумаг имеет вид

| —тоимость на конец года - —тоимость на | начало года | |

ƒоходность портфел€  —тоимость на начало года

—тоимость на начало года

|

4% инвестиций в опционы "колл"

урс акций на дату истечени€

ƒоходна€ диаграмма дл€ различных инвестиционных стратегий на фондовом рынке

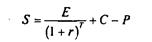

онтрольный вопрос 15.4. ѕокажите, как можно создать синтетическую акцию с помощью опциона "пут", опциона "колл" и бескупонной облигации номинальной стоимостью ≈.

ќ“¬≈“. ѕереписав уравнение 15.1 так, чтобы текуща€ цена акции сто€ла в левой части, получаем:

Ёто означает, что синтетическую акцию можно создать, приобрет€ беспроцентную облигацию номинальной стоимостью ≈, купив опцион "колл" и продав опцион "пут" на подлежащие акции.

г

—труктура платежей дл€ синтетической акции: бескупонна€ облигаци€ плюс опцион "колл" минус опцион "пут"

| инвестиционна€ позици€ | —тоимость на момент истечени€ | |

| ѕри ST < ≈ | ѕри ST > ≈ | |

| Ѕеспроцентна€ облигаци€ номинальной стоимостью ≈ | ≈ | ≈ |

| ѕокупка опциона "колл" | ST-E | |

| ѕродажа опциона "пут". | ST-E | |

| ќблигаци€ плюс опцион "колл" минус опцион "пут" | ST | ST |

онтрольный вопрос 15.5. ѕредположим что при данном уровне изменчивости курса акций S = 100 долл., ≈ = 100 долл., “ = 1 год, г = 0,08 и – = ё долл. ƒалее предположим, то изменчивость курса растет и цена опциона "колл " достигает 20 долл. акой должна быть нова€ цена опциона "пут", если S, ≈, “, и г не мен€ютс€?

|

|

|

ќ“¬≈“. —тоимость опциона "пут" должна возрасти на такую же величину, как и стоимость опциона "колл", в данном случае это составл€ет 2,59 долл. “аким образом стоимость опциона "пут" составит 12,59 долл.

онтрольный вопрос 15.6. ѕредположим, что изменчивость курса акций, лежащих в основе опциона, выше, чем в рассмотренном выше примере. урс акций может в течение года повыситьс€ или упасть на 30%. ѕримените двухступенчатую модель дл€ определени€ цены опциона.

ќ“¬≈“.

–азность цен акций

_ 30 долл. - 0 _ Д -130 долл. - 70 долл.

—умма, котора€ беретс€ взаймы, представл€ет собой максимальную сумму, котора€ может быть гарантированно выплачена с процентами на момент наступлени€ срока истечени€ опциона. ѕоскольку в данном примере худший возможный результат соответствует стоимости половины пакета акций, т.е. 35 долл., то ее необходимо дисконтировать по безрисковой процентной ставке 5%. ¬ результате получаем 33,33 долл.

÷ена опциона "колл" равна затратам на формирование дублирующего портфел€, которые определ€ютс€ как произведение коэффициента хеджировани€ на текущую цену акций за вычетом вз€той в долг суммы. ¬ соответствии с законом единой цены это и есть цена опциона "колл":

— =0,5-33,33 долл. = 50 долл. - 33,33 долл. =16,67 долл.

онтрольный вопрос 15.7. ѕредположим, что изменчивость курса акций, лежащих в основе опциона, равна не 0,2, как в рассмотренном выше примере, а 0,3. „ему равна приблизительна€ цена опциона "колл "?

ќ“¬≈“: —-0,4 х 0,3 х 100 долл. = 12 долл.

онтрольный вопрос 15.8. акой была бы доходность при погашении облигаций Debtco в рассмотренном выше частном случае?

ќ“¬≈“. ѕрин€в в качестве приближенной оценки акционерного капитала 12 млн долл., получаем

D Х= 100 млн долл. -12 млн долл. =88 млн долл. ѕоэтому непрерывно начисл€ема€ по облигаци€м процентна€ ставка R равна

R = In (108,33/88)= 0,2078, или 20,78% годовых.

¬опросы и задани€

ƒоходные диаграммы.

1. ѕостройте доходную диаграмму дл€ европейского опциона "пут" с ценой исполнени€ ≈, выписанного на акции, текущий курс которых ра вен S, если

Ўаблон

а. ¬ы занимаете длинную позицию (т.е. приобретаете опцион "пут)Х №. ¬ы занимаете короткую позицию (т.е. продаете опцион "пут")-

15.9-15.11

2. ѕостройте доходную диаграмму дл€ портфел€ ценных бумаг, в который вход€т один европейский опцион "колл" и один европейский опцион "пут" с одинаковыми сроками истечени€ и одинаковой ценой исполнени€ ≈, если оба эти опциона выписаны на акции, курс которых равен S.

»нвестирование с применением опционов

3. √одова€ безрискова€ процентна€ ставка составл€ет 4%, а фондовый индекс Globalex равен 100. ÷ена опциона "колл" на индекс Globalex со сроком истечени€ через один год и ценой исполнени€ 104 составл€ет 8% от текущего значени€ данного индекса. ѕредположим, что ожидаема€ дивидендна€ доходность акций, вход€щих в расчет индекса Globalex, равна нулю. ” вас есть 1 млн долл., предназначенный дл€ инвестиций на следующий год. ¬ы собираетесь вложить определенную часть денег в годичные казначейские вексел€ дл€ того, чтобы, по крайней мере, вернуть первоначальный 1 млн долл., а остальные деньги намерены использовать дл€ покупки опционов "колл" на индекс Globalex.

а. ѕостройте доходную диаграмму дл€ своих инвестиций исход€ из того, что определенную сумму вы вкладываете в опционы на индекс Globalex. ќткладывайте значени€ индекса Globalex по горизонтали, а доходность портфел€ ценных бумаг Ч по вертикали. „ему равен наклон графика доходной диаграммы справа от значени€ индекса, составл€ющего 104 процента?

№. ѕредположим, вы считаете, что с веро€тностью 0,5 индекс Globalex повыситс€ через год на 12%, с веро€тностью 0,25 он вырастет на 40%, а с веро€тностью 0,25 снизитс€ на 20%. аково распределение веро€тности дл€ доходности вашего портфел€ ценных бумаг?

|

|

|

”равнение паритета между опционами "пут" и "колл"

4.

а. ѕокажите, как можно продублировать годичную бескупонную облигацию номинальной стоимостью 100 долл. с помощью акций, опциона "пут" и опциона "колл".

№. ѕредположим, что S = 100 долл., – = 10 долл. и — = 15 долл. „ему должна быть равна годова€ безрискова€ процентна€ ставка?

с. ѕокажите, что в случае, если годова€ безрискова€ процентна€ ставка меньше, чем значение, найденное вами в качестве ответа на вопрос (№), должна существовать возможность арбитража. (ѕодсказка. ÷ена годичной бескупонной облигации окажетс€ завышенной.)

5. ≈вропейский опцион "колл" сроком на 90 дней на акции Toshiro Corporation в насто€щее врем€ продаетс€ по цене 2000 иен, в то врем€, как текуща€ цена самих акций составл€ет 2400 иен. ¬ыпускаемые правительством японии дев€ностодневные бескупонные облигации продаютс€ по цене 9855 иен при номинальной стоимости 10000 иен. ќпределите цену европейского опциона "пут" по этим акци€м сроком на 90 дней, если и опцион "колл", и опцион "пут" имеют одинаковую цену исполнени€ в 500 иен.

6. ‘инансовый магнат √ордон √екко сформировал портфель ценных бумаг, состо€щий из дес€ти 90-дневных казначейских векселей —Ўј, каждый номинальной стоимостью 1000 долл., текуща€ цена каждого вексел€ 990,10 долл., и 200 опционов "колл", сроком на 90 дней, каждый из которых выписан на акции Paramount и имеет цену исполнени€ 50,00 долл. √екко предлагает вам обмен€ть этот портфель на 300 акций Paramount, оцениваемых на данный момент в 215,00 долл. за акцию. ѕредположим, что 90-дневные европейские опционы "пут" на акции Paramount с ценой исполнени€ 50,00 долл. оцениваютс€ в насто€щее врем€ в 25,00 долл.

а. ќпределите цену содержащихс€ в портфеле √екко опционов "колл". №. —огласились бы вы прин€ть предложение √екко, или нет?

7. јкции Kaukonen, Ltd., занимающейс€ поставками тунца, в насто€щее врем€ оцениваютс€ в 500,00 долл., в то врем€ как годичные европейские опционы "колл" на эти акции с ценой исполнени€ 200,00 долл., продаютс€ по 400,00 долл., а европейские опционы "пут" с тем же сроком истечени€ и ценой исполнени€ продаютс€ по 84,57 долл.

а. ќпределите доходность продаваемой сегодн€ годичной бескупонной казначейской облигации —Ўј.

№. ≈сли эта доходность окажетс€ на уровне 9%, предложите схему прибыльных сделок дл€ использовани€ возможности арбитража.

ƒвухступенчата€ модель оценки стоимости опционов

8. ѕримените двухступенчатую модель оценки стоимости опционов к выводу формулы дл€ определени€ цены опциона "пут".

9. “екущий курс акций расположенного в Ќовом ќрлеане издательства Drummond, Griffin and McNabb составл€ет 100,00 долл., однако через 90 дней ожидаетс€ повышение курса до 150,00 долл. или снижение до 50,00 долл., в зависимости от реакции критиков на изданную ими биографию Ёзры ѕонд. ћожете ли вы определить цену европейского опциона "колл", выписанного на акции DGM с ценой исполнени€ 85,00 долл. »сходите из того, что безрискова€ процентна€ ставка в течение следующих 90 дней составит 0,01.

ћодель Ѕлэка-Ўоулза

10.

а. »спользуйте модель Ѕлэка-Ўоулза дл€ определени€ цены европейского опциона "колл", выписанного сроком на три мес€ца на акции без выплаты дивидендов, текуща€ цена которых составл€ет 50 долл. ѕредположите, что цена исполнени€ равна 51 долл., непрерывно начисл€ема€ безрискова€ процентна€ ставка составл€ет 8% годовых, а о равно 0,4.

№. аков состав дублирующего портфел€ дл€ этого опциона "колл"? с. ѕримените уравнение паритета опционов "пут" и "колл" к выводу формулы ЅлэкаЧЎоулза дл€ цены соответствующего опциона "пут".

11. ѕредставьте себе, что вы работаете финансовым аналитиком в сингапурской инвестиционной компании Yew and Associates и к вам обратилс€ клиент с вопросом, следует ли ему купить европейские опционы "колл" на акции Rattan, Ltd., продающиес€ в насто€щее врем€ по цене 30,00 долл. —Ўј. ÷ена исполнени€ этих опционов равна 50,00 долл. урс акций Rattan в насто€щее врем€ составл€ет 55,00 долл., а риск этих акций, измер€емый дисперсией, составл€ет 0,04. „то вы посоветуете клиенту, если дата истечени€ дл€ этих опционов наступает через 25 дней, а безрискова€ процентна€ ставка дл€ этого периода составл€ет 5%? ќценка ценных бумаг корпорации с применением двухступенчатой модели

12. ‘ирма Lorre and Greenstreet, Inc., поставщик античных статуй, имеет в насто€ шее врем€ акционерный капитал, оцениваемый в 100000 долл., и должна в платить через 90 дней 10000 долл. номинальной стоимости проданных части лицам бескупонных облигаций. этому времени ожидаетс€ ознакомление ш рокой публики с результатами независимой экспертизы нового поступлен ћальты, причем ожидаетс€ рост стоимости активов до 170000 долл. в случае, если эта стату€ будет признана подлинной, но вместе с тем возможно и уменьшение всего лишь до 45000 долл., если ее объ€в€т подделкой. ¬ последнем случае фирма будет объ€влена банкротом и акционеры будут вынуждены уступить право на активы фирмы держател€м облигаций.

а. ћожете ли вы выразить текущую совокупную стоимость акционерного капитала фирмы Lorre and Greenstreet в виде зависимости от стоимости активов фирмы и номинальной стоимости непогашенных облигаций?

№. —уществует ли св€зь между полученным вами выражением дл€ стоимости акционерного капитала и стоимостью 90-дневного европейского опциона "колл" на совокупные активы фирмы?

с. ћожете ли вы выразить текущую совокупную стоимость выпущенных фирмой Lorre and Greenstreet облигаций через стоимость активов фирмы и номинальную стоимость непогашенных облигаций?

d. —уществует ли св€зь между текущей стоимостью выпущенных этой фирмой облигаций, текущим значением стоимости безрисковых облигаций с такими же сроком погашени€ и номинальной стоимостью и европейским опционом "пут", выписанным на совокупные активы фирмы? ак можно было бы использовать такую св€зь дл€ того, чтобы выразить стоимость рискованных облигаций через безрисковые облигации и стоимость дополнительных гарантий фирмы?

13. —пециализирующеес€ на заказе билетов агентство Gephardt, Armey and Gore эмитировало на этой неделе 80 облигаций номинальной стоимостью 1000 долл. кажда€ со сроком погашени€ один год. ‘инансовые аналитики утверждают, что через год стоимость активов GAG будет составл€ть 160000 долл., если –уперт ћердок сумеет приобрести Washington Press Club и начнет ставить в нем комедии, 130000 долл., если ћердок приобретет этот клуб, но сохранит существующий репертуар, и 20000 долл. в том случае, если ћердок построит другой театр комедии в ¬ашингтоне. –аботающие в этой области аналитики также предсказывают, что активы второй аналогичной фирмы, Yeltsin Yuks, Ltd., будут в соответствии с выполнением приведенных выше условий равн€тьс€ 100000 долл., 100000 долл. или 40000 долл. ѕредположим, что инвесторы могут приобретать портфели ценных бумаг, включающие акции агентства GAG и фирмы YY Ltd., а также покупать или продавать коротко годичные бескупонные государственные облигации с безрисковой процентной ставкой 0,10 годовых.

а. ”кажите три разных величины стоимости совокупного акционерного капитала агентства GAG, которые будут наблюдатьс€ через год дл€ трех указанных выше возможных случаев.

№. —компонуйте портфель, денежные платежи по которому в точности совпадут с платежами, даваемыми портфелем, полностью состо€щим только из акций агентства GAG.

с. ќпределите текущую рыночную стоимость акций агентства GAG исход€ из того, что в обращение выпущено 10000 акций, текуща€ рыночна€ стоимость активов агентства GAG составл€ет 120000 долл., а текуща€ рыночна€ стоимость активов фирмы YY Ltd. равна 85725 долл.

d. ќпределите при этих же услови€х текущую рыночную стоимость выпущенной агентством GA G облигации исход€ из того, что выпущено 80 облигаций. акой будет доходность при погашении дл€ таких облигаций?