характерным чертам развивающихс€ рынков относ€т высокую инфл€цию, наличие политических и общеэкономических рисков. ќтносительно оценки проектов эти факторы привод€т к росту требуемой доходности владельцев капитала. ƒругой особенностью €вл€етс€ слабое развитие контрактов и конфликты интересов различных владельцев капитала с попытками их решить не всегда цивилизованными способами. ¬ результате к чисто финансовым ограничени€м на увеличение капитала добавл€ютс€ нефинансовые.

Ќапомним, что финансовым ограничением на прин€тие проекта €вл€етс€ превышение стоимости капитала над доходностью проекта. ѕри высокой инфл€ции и риске инвестировани€, когда государство предлагает на рынке высокодоходные об€зательства, требуема€ доходность инвесторов высока, что выражаетс€ в росте стоимости капитала дл€ компании. Ќе всегда удаетс€ найти варианты инвестировани€ в реальные активы, доходность по которым превышала бы высокую стоимость капитала.

ѕримером нефинансовых ограничений на размер капитала €вл€етс€ отказ от увеличени€ как собственного, так и заемного капитала из-за бо€зни потери контрол€ или усилени€ требований открытости принимаемых решений. ’арактерно при этом создание вертикально интегрированных холдингов с ограничени€ми на решени€, принимаемые руководством дочерних компаний, юридически €вл€ющихс€ самосто€тельными. ћатеринска€ компани€ берет на себ€ функции не только контрол€ над денежными потоками, но и перераспределени€ их, ограничива€ размер средств, по которым дочерн€€ компани€ может самосто€тельно принимать инвестиционные решени€.

¬ысока€ инфл€ци€ может быть учтена путем корректировки денежных потоков. “радиционный метод оценки проектов предполагает прогноз денежных потоков в текущих ценах или корректировку чистых денежных потоков на задаваемую инфл€ционную составл€ющую. „тобы отразить различи€ в изменении цен по затратам и доходам, более правильным будет прогноз по всем затратным стать€м и по стать€м денежных поступлений в будущих ценах. —ледует помнить о соблюдении принципов адекватности денежных потоков и выбираемой ставки дисконтировани€ при расчете чистого эффекта (NPV) по проекту.

1. ≈сли инфл€ционные ожидани€ отражаютс€ в денежных потоках, то в качестве ставки дисконтировани€ выбираетс€ значение номинальной процентной ставки. ≈сли рассматриваютс€ очищенные от инфл€ции денежные потоки, т.е. строитс€ прогноз в неизменных ценах, то ставкой дисконтировани€ €вл€етс€ реальна€ процентна€ ставка.

2. ѕредположение о периодичности поступлени€ денежного потока должно соответствовать прогнозу инфл€ционной составл€ющей и премии за риск в ставке дисконтировани€.

3. ≈сли в денежных потоках отражены финансовые решени€, т.е. вычтены затраты по обслуживанию заемных средств, то ставка дисконтировани€ отражает риск владельцев только собственного капитала.

4. ≈сли денежные потоки показывают значени€ отдачи по проекту, доступной всем владельцам капитала (и собственного, и заемного), то ставка дисконтировани€ отражает риск инвестировани€ всех владельцев капитала как средневзвешенной величины.

|

|

|

–ассмотрим первый принцип адекватности.

где i Ц ожидаема€ инфл€ци€ за период. ќбозначим через  , очищенные от инфл€ции чистые денежные потоки (inflation-adjusted cash flow), а через

, очищенные от инфл€ции чистые денежные потоки (inflation-adjusted cash flow), а через  номинальные чистые денежные потоки по проекту в период t.

номинальные чистые денежные потоки по проекту в период t.  .

.

ѕриведенна€ к начальному моменту оценка денежных потоков по проекту при использовании расчетной реальной процентной ставки должна считатьс€ следующим образом:

“еоретически полученное значение текущей оценки и чистого эффекта (NPV) должно совпадать с вариантом расчета в номинальных значени€х (исход€ из формулы ‘ишера, устанавливающей св€зь между реальной и номинальной процентными ставками):

„то касаетс€ второго принципа адекватности, то ежедневно компани€ имеет притоки денежных средств (за реализованную продукцию, продаваемые внеоборотные активы, авансовые платежи и т.п.) и оттоки (выплата заработной платы, перечисление налогов, оплата покупаемых оборотных и внеоборотных активов). ѕри рассмотрении проекта возникает проблема выбора адекватного укрупнени€ периодов получени€ чистых денежных потоков.

“радиционное рассмотрение оценки проектов строитс€ на предположении, что все денежные потоки поступают в конце прогнозируемого года. “акое рассмотрение денежных потоков по проекту адекватно действительности за исключением р€да случаев:

Х высока€ инфл€ци€, обычно характерна€ дл€ развивающихс€ рынков;

Х большие объемы денежных потоков и короткий срок функциониро-вани€ проекта;

Х высокий уровень риска.

»нфл€ционные составл€ющие часто снимаютс€ рассмотрением потоков в твердой валюте. ќдной из попыток согласовани€ прогнозов по проекту с действительностью €вл€етс€ дробное рассмотрение потоков, предполага€, что они поступают в течение года. —тавка дисконтировани€ должна быть скорректирована. Ќапример, если оценивать проект в –оссии с чистым денежным потоком 100 тыс. долл. в квартал на отрезке 2 года, то с учетом рискованности бизнеса требуема€ доходность может составл€ть 36% годовых в валюте. ѕри использовании предпосылки о поступлении денежных потоков в конце года текуща€ оценка будущих чистых поступлений по проекту составит 400/1,36 + 400 /1,362 = 510,38 тыс. долл.

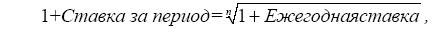

Ётот расчет не учитывает возможности реинвестировани€ по ходу получени€ денежных потоков в течение года, что неверно при высокой альтернативной стоимости капитала. — учетом ежеквартальных поступлений денежных потоков оценка проекта окажетс€ выше. ѕри этом предполагаетс€, что в рассматриваемые моменты времени поступающих средств достаточно дл€ покрыти€ текущих расходов или, что более точно, накопленные чистые поступлени€ во времени не отрицательны и по проекту не требуетс€ дополнительного финансировани€. ≈жеквартальна€ процентна€ ставка будет найдена из соотношени€

где n - число периодов за год. ¬ нашем примере n = 4. орень четвертой степени из 1,36 равен 1,0799, и ставка за квартал составит в рассматриваемом примере 7,99%.

“екуща€ оценка чистых поступлений по проекту составит 8-периодныи аннуитет в 100 тыс. ден. ед. при ставке приблизительно 8% за период. ѕо табл. 2 ѕриложени€ 2 находим, что PV = 100 тыс. (5,7466) = 574,66 тыс. долл. “ака€ оценка проекта более адекватно отражает возможный результат инвестировани€.

«аключение

Х ѕервым этапом разработки программы капиталовложений (инвестировани€ в реальные активы) фирмы €вл€етс€ анализ потенциальных проектов и выбор приемлемых. Ётот анализ включает: 1) оценку инвестиционных затрат по годам (в самом простом случае затраты осуществл€ютс€ в текущем году t = 0); 2) оценку чистых денежных потоков; 3) расчет эффекта от проекта. ѕри постановке цели максимизации рыночной оценки капитала единственным критерием прин€ти€ проекта €вл€етс€ положительное значение чистого дисконтированного дохода (NPV) по проекту. ƒл€ оценки NPV необходимо определить ставку дисконтировани€ будущих денежных потоков и включить в расчет фактор риска. ¬ключение в формулу NPV риска рассматриваетс€ в гл. 8. ¬ данной главе были показаны особенности расчета различных показателей эффективности проекта при предположении о безрисковых денежных потоках.

|

|

|

Х ѕри прогнозе денежных потоков необходимо учитывать особенности учета затрат, амортизационных отчислений и налоговых платежей, расчет которых различен в различных странах. јвтоматическое копирование западной практики расчетов может привести к ошибкам. ƒл€ нестандартных денежных потоков (например, по финансовому лизингу) должны быть применены специальные схемы.

Х ¬ реальной работе компании не всегда осуществл€ют выбор инвестиций по классической схеме инвестиционного анализа. ћетоды срока окупаемости, средней доходности, внутренней нормы доходности наход€т широкое применение. ѕростота расчета и нагл€дность получаемого результата делают их привлекательными. аждый метод дает финансовому менеджеру новую информацию о проекте, и часто оценка инвестиционных возможностей включает комплексное применение рассматриваемых методов.

Х —рок окупаемости проекта рассчитываетс€ как временной промежуток в годах, в течение которого происходит возмещение вложенных инвестиций. ”чет опционных возможностей по проекту (ликвидации проекта) уменьшает расчетный срок окупаемости и ведет к увеличению эффекта. ћодификацией этого метода €вл€етс€ расчет срока окупаемости по дисконтированным денежным потокам, что приводит к увеличению исходного срока окупаемости. ƒл€ применени€ метода необходимо задание нормативного срока окупаемости.

Х ћетод средней доходности инвестиций строитс€ на сравнении прогнозируемой доходности проекта с целевым коэффициентом доходности. “ак же как и метод срока окупаемости, этот подход игнорирует временную стоимость денег.

Х ћетод чистого дисконтированного дохода (чистой текущей стоимости или чистого приведенного эффекта, NPV) строитс€ на сравнении текущей оценки будущих поступлений и текущей оценки затрат. ѕри превышении чистых поступлений над затратами проект принимаетс€. ƒл€ проектов снижени€ издержек метод модифицируетс€ в метод минимума затрат.

Х ¬нутренн€€ норма доходности (IRR) показывает ту ставку дисконтировани€, при которой текуща€ оценка будущих поступлений совпадает с текущей оценкой затрат. Ёто максимально допустима€ стоимость капитала проекта. ѕроект принимаетс€, если внутренн€€ норма доходности превышает оцененную стоимость капитала по проекту.

Х ≈сли проекты независимы и могут приниматьс€ одновременно, то использование в качестве критериев оценки NPV и IRR приводит к одинаковым рекомендаци€м. ƒл€ альтернативных проектов возможны расхождени€. ћетод IRR строитс€ на очень сильных допущени€х и должен учитывать характер денежного потока, поэтому предпочтение отдаетс€ методу NPV. ћодификаци€ метода IRR позвол€ет сн€ть наиболее сильное ограничение Ч о реинвестировании прогнозируемых денежных потоков с неизменной доходностью, равной значению IRR.

Х ѕоказатели реализации проекта по денежным потокам (операционна€ прибыль, чиста€ прибыль, чистый денежный поток) и показатели текущей отдачи на вложенные средства (доходность активов, собственного капитала) слабо св€заны с вкладом проекта в рыночную капитализацию, что не позвол€ет по ним проводить мониторинг и строить схемы вознаграждени€ менеджеров разного уровн€. –€д компаний, ориентирующихс€ на максимизацию рыночной капитализации, выбрали в качестве показател€ оценки текущих изменений периодически рассчитываемое значение экономической добавленной стои- мости (economic value added Ч EVA). ак агрегированный показатель оценки EVA совпадает с классическим показателем оценки проекта „ƒƒ или NPV. MVA = ∑PV(EVA) = NPV, как текущий показатель обладает большей "объ€снительной способностью" по динамике цены акции и может рассматриватьс€ как основа дл€ построени€ системы мониторинга проекта.

|

|

|

¬опросы. «адачи. –ешени€

1. –ассматриваетс€ инвестиционный проект со следующими чистыми денежными потоками: —=-1, —1=2,3, —2=-1,32. Ѕудет ли прин€т такой проект при альтернативной стоимости капитала (требуемой доходности) 15%? ѕокажите алгоритм прин€ти€ решени€, использу€ критерий IRR. ћожет ли значение внутренней нормы доходности быть найдено из уравнени€

-1 (1 + r)2 + 2,3 (1 + r) - 1,32 = 0?

–ешение

—тандартный подход вычислени€ внутренней нормы доходности заключаетс€ в приравнивании NPV к нулю. –ешение уравнени€ по данному проекту дает два корн€: г, = 10%, г2 = 20%. ≈сли уравнение имеет несколько корней, то не следует выбирать один из них и сравнивать его с требуемой доходностью, как рекомендует критерий ¬Ќƒ (IRR). ƒва корн€ уравнени€ указывают границы интервала требуемой доходности по проекту, при которых проект приемлем. ¬ данном случае проект следует прин€ть при значении требуемой доходности (стоимости капитала) в пределах от 10 до 20%. ѕри стоимости капитала 15% проект обеспечивает положительное значение чистого дисконтированного дохода.

2. ћетод ћ¬Ќƒ устран€ет р€д недостатков традиционной оценки ¬Ќƒ. ќпишите ситуацию, когда критерии ћ¬Ќƒ и NPV приведут к разным выводам. ак устранить эти противоречи€?

–ешение

ѕротиворечи€ в оценке возможны дл€ альтернативных проектов, когда требуетс€ выбрать лучший. ƒве ситуации могут привести к противоречивым оценкам: сравнение проектов с различными сроками функционировани€; сравнение альтернативных проектов с различными инвестиционными затратами. —ледует иметь в виду, что рыночный подход в финансовом менеджменте (при котором максимизируетс€ рыночна€ оценка капитала) признает только критерий NPV и только за этим методом право окончательного решени€. „тобы дл€ проектов с различными сроками функционировани€ работал критерий ћ¬Ќƒ, алгоритм расчета должен быть скорректирован: 1) срок функционировани€ более длительного проекта принимаетс€ за базу; 2) по длительному проекту ћ¬Ќƒ рассчитываетс€ стандартным образом; 3) ћ¬Ќƒ краткосрочного проекта оцениваетс€ на базовом временном отрезке, недостающие значени€ денежного потока принимают нулевые значени€. “аким образом, расчет проводитс€ по равным временным интервалам.

3. омпани€ ¬ прогнозирует генерировать чистый денежный поток 100 тыс. ден. ед. в году 1 и 200 тыс. в году 2. ќтдел инвестиций рассчитал, что если будет сделано немедленное инвестирование 35 тыс. ден. ед., то можно ожидать получение 190 тыс. ден. ед. в году 1 и 150 тыс. в году 2. »нвестирование не мен€ет риск текущей де€тельности. —тоимость капитала компании ¬ равна 12%.

1. ќцените значение чистого дисконтированного дохода по проекту, предлагаемому отделом инвестиций, и ¬Ќƒ проекта. ѕочему ¬Ќƒ €вл€етс€ плохой оценкой доходности проекта?

2. –уководство компании ¬ обнаружило ошибку в расчетах инвестиционных затрат. — учетом рекламных издержек инвестиции должны возрасти с 35 тыс. до 42 тыс. ден. ед. ѕересчитайте „ƒƒ и ¬Ќƒ. ѕочему теперь ¬Ќƒ дает плохую оценку?

–ешение

1. ѕредставим денежные потоки компании ¬ в виде таблицы:

| ѕотоки по годам | |||

| ƒенежные потоки без проекта ѕотоки по проекту до обнаружени€ ошибки ѕриростные потоки | -35 | -50 |

“ак как проект не мен€ет риск де€тельности, дл€ оценки NPV может быть прин€та текуща€ стоимость капитала компании. ѕри ставке 12% NPV= Ч35 + 90/1,121 - 50/1,122 = 5,4974 тыс. ден. ед. ѕоскольку NPV положительный, проект может быть прин€т при сформулированных услови€х. ѕо приростному денежному потоку имеетс€ два значени€, при которых NPV = 0.

|

|

|

¬Ќƒ равна -18,81% и 75,95%. “ребуетс€ построить зависимость NPV(k). ѕри k = 0 NPV= 5. ѕри значении ставки от 0 до 75,94% чистый дисконтированный доход по проекту будет иметь положительное значение.

2. ѕредставим денежные потоки компании ¬ после обнаружени€ ошибки:

| ѕотоки по годам | |||

| ƒенежные потоки без проекта ѕотоки по проекту после обнаружени€ ошибки ѕриростные потоки | -42 | -50 |

NPV= -1,503. ѕроект не следует принимать. ¬Ќƒ не существует (нет ставки дисконтировани€, котора€ давала бы положительное значение NPV).

4. ѕредположим, что два инвестиционных проекта порождают следующие денежные потоки:

| √од | ѕроект ј | ѕроект Ѕ |

| -17 | -17 11 (чистые поступлени€) |

–ассчитайте доходность инвестиций дл€ каждого года при предположении равномерной амортизации и полного списани€ оборудовани€ за срок жизни проекта. ѕримените метод средней доходности инвестиций и выберите наилучший проект, если нормативное значение доходности 14%.

–ешение

ќценка прибыли и доходности проектов ј и Ѕ по годам:

| ѕроект ј | ѕроект Ѕ | |||

| 1-й год | 2-й год | 1-й год | 2-й год | |

| „истые денежные потоки | » | |||

| јмортизаци€ (17/2) | 8,5 | 8,5 | 8,5 | 8,5 |

| ѕрибыль | 0,5 | 2,5 | 2,5 | 0,5 |

| јктивы в среднем: (‘онды начала года + ‘онды конца года)/2 | 12,75 | 4,25 | 12,75 | 4,25 |

| ƒоходность | 0,03 | 0,58 | 0,19 | 0,11 |

| —редн€€ доходность | 0,3 | 0,15 |

ќба проекта могут быть прин€ты. ѕо методу средней доходности проект ј предпочтительнее. ритерий „ƒƒ даст другие рекомендации.

5. омпани€ располагает ангаром, принос€щим денежный доход в конце каждого года (перпетуитет), равный 30 ден. ед. Ќалоги отсутствуют. Ётот доход сохранитс€ на неограниченный период времени, если ангар оставить без изменений. ќднако компани€ может снести старый ангар и построить на его месте новый, модернизированный, что обойдетс€ в 120 ден. ед. —рок службы нового ангара бесконечен. јльтернативна€ стоимость капитала Ч 10%.

1. акие ежегодные денежные потоки должен приносить новый ангар, чтобы его было выгодно построить вместо старого (предположим, доходы по ангару не мен€ютс€ по годам)?

2. ак введение в рассмотрение налогов сможет изменить ответ?

3. »зменитс€ ли ответ, если компани€ в насто€щий момент может продать ангар за 400 ден. ед.?

–ешение

1. “екуща€ оценка старого ангара: 30/0,1 = 300 ден. ед. јльтернативные варианты использовани€ ангара и земли под ним будут прин€ты, если текуща€ оценка чистых поступлений по ним превысит 300 ден. ед. NPV проекта постройки нового ангара = -120 + X/0,1. —троительство нового ангара будет предпочтительнее, если -120 + X/0,1 > 300, ’> 42 ден. ед. ≈сли новый ангар будет приносить ежегодно более 42 ден. ед., то его строительство Ч более привлекательный вариант.

2. ѕо новому ангару будет выплачиватьс€ налог на имущество. ѕо старому ангару выплаты завис€т от срока его службы (списан ангар или нет). Ќовый ангар позволит вычисл€ть амортизацию и тем самым снизит налоговые выплаты (возникнет новый шит). ѕри оценке денежного потока X эти факторы должны быть учтены.

3. ≈сли существует возможность продать ангар за 400 ден. ед., то вариант строительства нового ангара будет прин€т при выполнении услови€

-120 + X/0,1 >400, ’>52.

6. омпани€ рассматривает покупку оборудовани€, затраты по которому состав€т 10 тыс. ден. ед. (цена оборудовани€ с учетом доставки и монтажа). омпани€ прогнозирует равные чистые ежегодные денежные поступлени€ от использовани€ оборудовани€, срок окупаемости его оцениваетс€ в 5 лет.

—колько полных лет должен составл€ть жизненный цикл рассматриваемого оборудовани€, чтобы его приобретение было приемлемым? јльтернативна€ стоимость капитала, которую компани€ рассматривает при покупке оборудовани€, равна 10%.

–ешение

ƒенежные потоки по годам равны, поэтому при 5-летнем сроке окупаемости погашение 10 тыс. ден. ед. инвестиционных затрат произойдет, если ежегодные потоки состав€т 2 тыс. ден. ед. “аким образом, денежные потоки проекта (в тыс. ден. ед.) по годам имеют вид: Ч10; 2; 2; 2 и так далее.

ѕроект будет приемлем, если NPV> 0. ¬ данном случае требуетс€ найти такое число лет, чтобы (Ч10 + PV поступлений при ставке дисконтировани€ 10%) > 0 или PV поступлений > 10.

|

|

|

2 PVIFA (10%, ’ лет) > 10. PVIFA (10%, X лет) > 5. ѕо таблице текущей оценки аннуитета в ден. ед. в столбце 10% находим, что полное число лет дл€ выполнени€ услови€ PVIFA (10%, 8 лет) > 5 составл€ет 8.

–екомендуема€ литература

ќсновна€

Ѕригхем ё., √апенски Ћ. ‘инансовый менеджмент: ѕолный курс в 2 т.: ѕер. с англ. —ѕб.: Ёкономическа€ школа, 1997. “. 1. —. 208Ч238, 260-263.

’орн ƒж. .ван. ќсновы управлени€ финансами: ѕер. с англ. ћ.: ‘инансы и статистика, 1997. —. 339Ч379.

Ѕрейли –. ћайерс —. ѕринципы корпоративных финансов: ѕер. с англ. ћ.: ќлимп-бизнес, 1997. —. 77Ч95.

Ѕирман √., Ўмидт —. Ёкономический анализ инвестиционных проектов. ћ.: Ѕанки и биржи: ќбъединение ёЌ»“», 1997.

ƒополнительна€

ќванесов ј., „етвериков ¬. ѕоток платежей. ћЁЌƒ Ч мощное оружие аналитика // –ынок ценных бумаг. 1997. є 11. —. 46Ч49; є 12. —. 50Ч 53.

Berger P.G., Ofek E., Swary I. Investor Valuation of the Abandonment Option // Journal of Financial Economics. 1996. Vol. 42. October. P. 257Ч287.

Froot K.A., Stein J.C. Risk Management, Capital Budgeting, and Capital Structure Policy for Financial Institutions: An Integrated Approach // Journal of Financial Economics. 1998. Vol. 47. Issue 1. January. P. 55-82.

Baldwin C.Y. Clark K.B. Capabilities and Capital Investment: New Perspectives on Capital Budgeting // Journal of Applied Corporate Finance. 1992. Vol. 15. Summer. P. 67Ч82.

Barro R.J. The Stock Market and Investment // Review of Financial Studies. 1990. Vol. 3. P. 115-131.

Brennan M.J., Schwartz E.S. Evaluating Natural Resource Investments // Journal of Business. 1985. Vol. 58. April. P. 135-157.

Fama E.F., Jensen M.C. Organizational Forms and Investment Decisions // Journal of Financial Economics. 1985. Vol. 14. March. P. 101-118.

Gitman L.J., Maxwell Ch.E. A longitudinal Comparison of Capital Budgeting Techniques Used by Major U.S. Firms: 1986 Versus 1976 //Journal of Applied Business Research. 1987. P. 41-50.

Hodder J.E. Evaluation of Manufacturing Investments: A Comparison of U.S. and Japanese Practices // Financial Management. 1986. Vol. 15. Spring. P. 17-24.

Holland J. Capital Budgeting for International Business: A Framework for Analysis// Managerial Finance. 1990. Vol. 16. P. 1-6.

Larcker D The Association between Performance Plan Adoption and Corporate Capital Investment //Journal of Accounting and Economics.1983.Vol.5.April. P.3-30.

Laughton D.G., Jacoby H.D. Reversion, Timing Options and Long-term Decision-making // Financial Management. 1993. Vol. 22. Autumn. P. 225- 240.

Lee W.Y., Martin J.D., Senchak A.J. The Case for Using Options to Evaluate Salvage Values in Financial Leases // Financial Management. 1993. Vol. 22. Autumn. P. 33-41.

Lorie J.H., Savage L.J. Three Problems in Rationing Capital // Journal of Business. 1955. Vol. 28. October. P. 229-239.

Mackie-Mason J.K. Do Taxes Affect Corporate Financing Decisions//Journal of Finance. 1990. Vol. 45. December. P. 1471-1493

McLaughlin R., Taggart R.A. The Opportunity Cost of Excess Capacity // Financial Management. 1992. Vol. 21. Summer. P. 12Ч23.

Myers S. Interactions of Corporate Financing and Investment Decisions Ч lmpbcation for Capital Budgeting // Journal of Finance. 1974. Vol. 29. March. P. 125.

Ravid S.A. On Interactions of Production and Financial Decisions // Financial Management. 1988. Vol. 17. Fall. P. 87-99.

Quigg L. Empirical Testing of Real Option-pricing Models // Journal of Finance. 1993. Vol. 48. June. P. 621-640.

Whited T.M. Debt, Liquidity Constraints, and Corporate Investment: Evidence from Panel Data //Journal of Finance. 1992. Vol. 47. September. P. 1425Ч 1460.