1. ѕростой срок окупаемости –¬– ( Payback Period ) показывает вре≠м€, которое необходимо дл€ покрыти€ начальных инвестиций в пред≠при€тие Ђћойдодыр-сервисї за счет поступлений чистого денежного потока, генерируемого проектом.

»з табл. 11.10 (строка Ђостаток денежных средств на конец перио≠даї) видно, что окупаемость требуемых инвестиций (176,0 тыс. руб.) достигаетс€ в июне 2008 г. “аким образом, дл€ рассматриваемого пред≠при€ти€ простой период окупаемости составл€ет 7 мес€цев.

ќб€зательное условие реализации проекта Ч период окупаемости должен быть меньше длительности проекта Ч в рассматриваемом при≠мере выполнено.

2. ƒисконтированный срок окупаемости DPBP (Discounted Payback Period) может быть рассчитан аналогично –¬–, однако в этом случае чистый денежный поток дисконтируетс€ и аккумулируетс€ (таблица 13.4). –асчеты показывают, что положительное значение чистого денежного потока также отмечаетс€ в июне 2008 г., что и определ€ет дисконтиро≠ванный срок окупаемости равным 7 мес€цам.

“аблица 13.4. ƒисконтированный срок окупаемости

| 12.2007 | 01.2008 | 02.2008 | 03.2008 | 04.2008 | 05.2008 | 06.2008 | 07.2008 | |

| ќперационный денежный поток | 35960,000 | 35960,000 | 35960,000 | 4910,000 | 35960,000 | 35960,000 | 4910,000 | |

| »нвестиционный денежный поток | -176000,000 | |||||||

| „истый денежный поток | -176000,000 | 35960,000 | 35960,000 | 35960,000 | 4910,000 | 35960,000 | 35960,000 | 4910,000 |

| ƒисконтированный чистый денежный поток | -176000,000 | 35569,488 | 35183,217 | 34801,140 | 4700,166 | 34049,389 | 33679,626 | 4548,697 |

| јккумулированный чистый денежный поток | -176000,000 | -140430,512 | -10524736 | -70446,156 | -65745,990 | -31696,600 | 1983,026 | 6531,723 |

3. Ѕухгалтерска€ норма доходности ARR (Accounting Rate of Return) была рассчитана как отношение среднегодового чистого дохода к сред≠негодовому размеру инвестиций.

»з табл. 11.8 и 11.9 ћ. арпов вз€л суммарное значение показате≠лей чистого дохода за 1-й (161,320) и 2-й года (292,320) и рассчитал среднегодовой чистый доход:

—реднегодовой чистый доход D = (161,320 + 292,320)/2 -= 453,640/2 = 226,820 тыс. руб.

—реднегодовой размер инвестиций (с учетом остаточной стоимос≠ти активов 15 тыс. руб. по истечении срока реализации проекта) со≠ставит:

—реднегодовой размер инвестиций / = 1/2 х (176,0 + 15,0) = = 95,5 тыс. руб.

ARR (Accounting Rate of Return) = (226,820/95,5) x 100% -= 2,375 x 100% = 238%.

«начение показател€ свидетельствует о том, что каждый вложен≠ный в бизнес рубль инвестиций может принести предпринимателю 2,38 руб. чистого дохода.

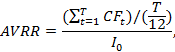

ќднако на практике часто используетс€ еще один показатель, который учитываетс€ при выдаче кредита. Ёто средн€€ норма рентабельности ин≠вестиций AVRR (Average Rate of Return), котора€ также характеризует доходность проекта, но рассчитываетс€ на основе денежных потоков как отношение среднегодовой суммы поступлений денежных средств от про≠екта к величине начальных инвестиций:

|

|

|

где CFt Ч денежный поток мес€ца t; T Ч длительность проекта в мес€≠цах; I 0 Ч начальные инвестиции.

Ётот показатель характеризуетс€ суммой денежных средств, кото≠рую проект создает относительно уровн€ вложенных инвестиций.

»з табл. 11.10 и 11.11 возьмем сумму поступлений от операционной де€тельности за первый и второй годы (338,370 тыс. руб. и 307,320 тыс. руб. соответственно) и рассчитаем отношение среднегодовой суммы поступлений от проекта к начальным инвестици€м:

AVRR = (645,690/(25/12))/17б,0 = 309,931/176,0 = 1,76, или 176%.

«начение показател€ средней нормы рентабельности инвестиций сви≠детельствует о том, что каждый рубль, вложенный в начальные инвести≠ции, приносит 1,76 руб. поступлений денежных средств.

4. „иста€ приведенна€ стоимость NPV (Net Present Value) характе≠ризует абсолютную величину чистого денежного потока от реализа≠ции проекта, который дисконтируетс€ (приводитс€ к начальному мо≠менту времени).

ѕроведенные расчеты (таблица 13.5 и 13.6) показывают, что NPV проекта со≠ставл€ет 390,091 тыс. руб.

“аблица 13.5. –асчет NPV за 2007 год

| 12.2007 | 01.2008 | 02.2008 | 03.2008 | 04.2008 | 05.2008 | 06.2008 | 07.2008 | |

| ќперационный денежный поток | 35960,000 | 35960,000 | 35960,000 | 4910,000 | 35960,000 | 35960,000 | 4910,000 | |

| »нвестиционный денежный поток | -176000,000 | |||||||

| „истый денежный поток | -176000,000 | 35960,000 | 35960,000 | 35960,000 | 4910,000 | 35960,000 | 35960,000 | 4910,000 |

| ƒисконтированный чистый денежный поток | -176000,000 | 35569,488 | 35183,217 | 34801,140 | 4700,166 | 34049,389 | 33679,626 | 4548,697 |

| јккумулированный чистый денежный поток | -176000,000 | -140430,512 | -105247,296 | -70446,156 | -65745,990 | -31696,600 | 1983,026 | 6531,723 |

“аблица 13.6. –асчет NPV за 2008 и 2009 годы

| 08.2008 | 09.2008 | 10.2008 | 11.2008 | 12.2008 | 01.2009 | 02.2009 | 03.2009 | 04.2009 | |

| ќперационный денежный поток | 35 960,000 | 35 960,000 | 4910,000 | 35 960,000 | 35 960,000 | 4910,000 | 35960,000 | 35960,000 | 4910,000 |

| »нвестиционный денежный поток | |||||||||

| „истый денежный поток | 35960,000 | 35960,000 | 4910,000 | 35960,000 | 35960,000 | 4910,000 | 35960,000 | 35 960,000 | 4910,000 |

| ƒисконтированный чистый денежный поток | 32 952,101 | 32 594,254 | 4402,109 | 31 890,175 | 31 543,860 | 4260,245 | 30862,471 | 30527,316 | 4122,953 |

| јккумулированный чистый денежный поток | 39483,824 | 72 078,078 | 76480,187 | 108370,362 | 139914,221 | 144174,466 | 175036,937 | 205564,253 | 209687,206 |

| 05.2009 | 06.2009 | 07.2009 | 08.2009 | 09.2009 | 10.2009 | 11.2009 | 12.2009 | ||

| ќперационный денежный поток | 35960,000 | 35960,000 | 4910,000 | 35960,000 | 35960,000 | 4910,000 | 35960,000 | 35960,000 | |

| »нвестиционный денежный поток | |||||||||

| „истый денежный поток | 35960,000 | 35960,000 | 4910,000 | 35960,000 | 35960,000 | 4910,000 | 35960,000 | 35960,000 | |

| ƒисконтированный чистый денежный поток | 29867,885 | 29543,531 | 3990,085 | 28905,352 | 28591,451 | 3861,499 | 27670,052 | ||

| јккумулированный чистый денежный поток | 239555,091 | 269098,622 | 273088,707 | 301994,059 | 330585,510 | 334447,009 | 362420,847 | 390090,899 |

|

|

|

“аким образом, об€зательное условие дл€ реализации проекта Ч нео≠трицательное значение показател€ NPV Ч выполн€етс€. —ледователь≠но, проект может быть прин€т к реализации.

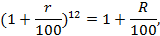

«аметим, что поскольку в рассматриваемой конкретной ситуации Ђћойдодыр-сервисї денежные потоки моделируютс€ помес€чно, то при выборе шага дисконтировани€ (мес€ц) годова€ ставка дисконти≠ровани€ должна быть пересчитана в мес€чную.

„итателю представл€етс€ возможность самосто€тельно произвести пересчет годовой ставки дисконтировани€, равной 14%, в мес€чную.

√одова€ и мес€чна€ ставки дисконтировани€ св€за≠ны между собой следующим соотношением:

где r Ч мес€чна€ ставка дисконтировани€; R Ч годова€ ставка дискон≠тировани€.

5. ¬нутренн€€ норма доходности IRR (Internal Rate of Return) дл€ проекта может быть рассчитана в электронных таблицах Excel с помо≠щью финансовой функции „»—“¬Ќƒќ’.

IRR = „»—“¬Ќƒќ’ (¬1: ¬25; Al: A25) = 469,16%,

где Bl: B25 Ч р€д поступлений денежного потока; Al: A25 Ч даты пла≠тежей, которые соответствуют операци€м с составл€ющими денежного потока (см. таблица 13.7).

“аблица 13.7. »сходные данные дл€ расчета IRR с помощью электронных таблиц Excel

| 12.2007 | 01.2008 | 02.2008 | 03.2008 | 04.2008 | 05.2008 | 06.2008 | 07.2008 | 08.2008 | 09.2008 | 10.2008 | 11.2008 | 12.2008 | ||||||||||||

| 35,960 | 35,960 | 35,960 | 4,910 | 35,960 | 35,960 | 4,910 | 35,960 | 35,960 | 4,910 | 35,960 | 35,960 | 35,960 | ||||||||||||

| 01.2009 | 02.2009 | 03.2009 | 04.2009 | 05.2009 | 06.2009 | 07.2009 | 08.2009 | 09.2009 | 10.2009 | 11.2009 | 12.2009 | |||||||||||||

| 4,910 | 35,960 | 35,960 | 4,910 | 35,960 | 35,960 | 4,910 | 35,960 | 35,960 | 4,910 | 35,960 | 35,960 | |||||||||||||

ѕроект считаетс€ приемлемым, если значение IRR не ниже требуе≠мой нормы доходности, котора€ определ€етс€ инвестором или инвес≠тиционной политикой компании.

6. »ндекс прибыльности PI (Profitability Index) €вл€етс€ относитель≠ным показателем эффективности проекта и определ€етс€ как отноше≠ние приведенной стоимости денежных поступлений к приведенной сто≠имости денежных выплат (включа€ первоначальные инвестиции):

–I = 566,091/176,0 = 3,22.

ќб€зательное условие реализации проекта: индекс прибыльности должен быть больше 1 Ч выполнено. —ледовательно, проект может быть прин€т.

–ассчитанные показатели экономической эффективности проекта сведены в табл. 13.8.

“аблица 13.8. ѕоказатели экономической эффективности бизнес-проекта предпри€ти€ Ђћойдодыр-сервисї

| є п/п | Ќаименование показател€ | «начение показател€ |

| —тавка дисконтировани€, % | 14,0 | |

| ѕериод окупаемости проекта –¬–, мес. | ||

| ƒисконтированный период окупаемости DPBP, мес. | ||

| Ѕухгалтерска€ норма доходности ARR, % | ||

| —редн€€ норма рентабельности инвестиций, % | ||

| „иста€ приведенна€ стоимость NPV, тыс. руб. | 390,091 | |

| »ндекс прибыльности PI | 3,22 | |

| ¬нутренн€€ норма доходности IRR,% | 469,16 |

јнализ чувствительности

÷ель анализа чувствительности Ч определить степень вли€ни€ от≠дельных варьируемых факторов на финансовые результаты проекта. „ем шире диапазон параметров, при которых финансовые результаты проекта остаютс€ в пределах приемлемых значений, тем лучше он за≠щищен от колебаний различных факторов, оказывающих воздействие на результаты реализации проекта.

јнализ чувствительности полезен при оценке риска проекта. ќн проводитс€ на этапе планировани€, когда необходимо прин€ть решени€ относительно исследуемых факторов. Ёти факторы анализируют≠с€ с точки зрени€ их вли€ни€ на осуществимость проекта и оценку его эффективности.

числу исследуемых факторов, подлежащих варьированию, отно≠с€тс€:

|

|

|

Х инфл€ци€;

Х объем продаж;

Х цена продукта (услуги);

Х издержки производства и сбыта (или их отдельные составл€ющие);

Х накладные расходы;

Х объем инвестиций (или их отдельных составл€ющих);

Х проценты за кредит;

Х задержка платежей;

Х длительность расчетного периода (момента прекращени€ реали≠зации проекта).

¬ качестве показателей, характеризующих финансовый результат проекта, могут использоватьс€ показатели эффективности проекта, а именно:

Х чиста€ приведенна€ стоимость (NPV);

Х внутренн€€ норма доходности (IRR);

Х срок окупаемости проекта (–¬–);

Х индекс прибыльности (–I).

јнализ чувствительности начинают с описани€ параметров окружа≠ющей среды: уровн€ инфл€ции, прогноза изменени€ обменного курса национальной валюты, данных по налогообложению. Ёти параметры не могут быть изменены посредством управленческих решений.

ѕроцедура проведени€ анализа чувствительности сводитс€ к сле≠дующему.

1. –ассчитывают базисный вариант проекта, при котором все иссле≠дуемые факторы принимают свои первоначальные значени€.

2. ¬ыбирают один из исследуемых факторов. ѕри этом рекоменду≠етс€ начинать с наиболее значимого фактора, задава€ его гранич≠ные значени€, соответствующие пессимистическому и оптимис≠тическому сценари€м.

3. ¬арьируют значение исследуемого фактора в определенном ин≠тервале при фиксированных значени€х остальных факторов.

4. ќценивают вли€ние изменений исследуемого фактора на пока≠затели эффективности проекта.

5. –ассчитывают показатель чувствительности как отношение про≠центного изменени€ критери€ Ч выбранного показател€ эффек≠тивности проекта (относительно базисного варианта) к измене≠нию значени€ фактора на один процент.

ѕодобным образом определ€ют показатели чувствительности по каж≠дому из анализируемых факторов. ќграничени€ при проведении анали≠за чувствительности св€заны с тем, что невозможно рассматривать одно≠временное изменение нескольких исследуемых факторов.

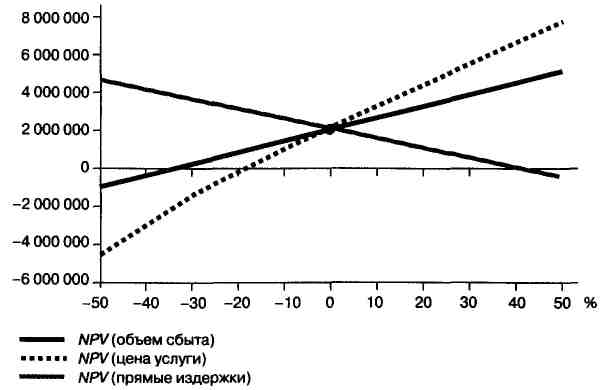

√рафически результаты проведени€ анализа чувствительности пред≠ставлены на рис. 13.3.

–ис. 13.3. јнализ чувствительности

ѕроект считаетс€ устойчивым, если при всех сценари€х развити€ со≠бытий он оказываетс€ эффективным и финансово реализуемым. »ны≠ми словами, если при всех рассмотренных сценари€х выполн€ютс€ сле≠дующие услови€:

Х чиста€ приведенна€ стоимость (NPV) положительна;

Х обеспечиваетс€ необходимый резерв финансовой реализуемости проекта (неотрицательна€ сумма накопленного сальдо денежно≠го потока от всех видов де€тельности на каждом шаге расчетного периода).

≈сли хот€ бы одно из указанных условий в каком-либо из рассмат≠риваемых сценариев не выполн€етс€, то рекомендуют провести более детальный анализ пределов возможных колебаний соответствующего фактора, уточнение его верхних границ. ≈сли и после такого уточне≠ни€ услови€ устойчивости не соблюдаютс€, то проект должен быть отклонен при отсутствии важной дополнительной информации.

»так, анализ чувствительности позвол€ет выделить наиболее важ≠ные факторы с точки зрени€ риска, а также разработать наиболее эф≠фективную стратегию реализации проекта.

онкретна€ ситуаци€ Ч создание предпри€ти€ Ђћойдодыр-сервисї(„асть D)