RRR предлагает меру соотношени€ доходности и риска, котора€ позво≠л€ет избежать недостатков коэффициента Ўарпа, обсуждавшихс€ в предыдущем разделе. роме того, RRR ближе к воспри€тию риска боль≠шинством трейдеров. RRR представл€ет собой среднюю прибыль с уче≠том реинвестировани€ (R), пересчитанную в годовом исчислении и де≠ленную на усредненное за год максимальное снижение стоимости ак≠тивов (average maximum retracement measure Ч AMR):

RRR R

AMR

„тобы выразить в процентах годовых ожидаемую (среднюю) доходность не≠которого интервала времени, необходимо умножить ожидаемую на интерва≠ле прибыль на количество данных интервалов в году (,/12 дл€ мес€чных дан≠ных). „тобы перевести в годовое исчисление стандартное отклонение, необ≠ходимо умножить стандартное отклонение на интервале на квадратный корень количества интервалов в году (Vl2 дл€ мес€чных данных). Ёто преобразова≠ние стандартного отклонени€ Ч следствие того факта, что если интервалы не≠зависимы, то дисперси€ прибыли на более длинном интервале (например, год) равна дисперсии на более коротких интервалах (например, мес€ц), умножен≠ной на количество коротких интервалов в длинном интервале (например, на 12). “аким образом, стандартное отклонение прибыли на длинном интервале равно стандартному отклонению прибыли на коротком интервале, умножен≠ному на квадратный корень количества коротких интервалов в длинном ин≠тервале (поскольку стандартное отклонение определ€етс€ как квадратный ко≠рень дисперсии).

√Ћј¬ј 21. измерение результативности торговли 743

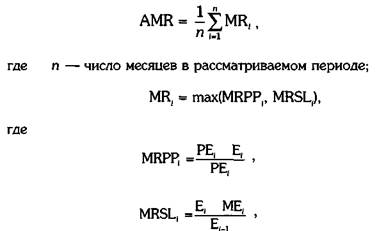

R можно вычислить как отношение суммарного прироста стоимос≠ти активов управл€ющего или системы за год, к величине активов на начало года, при условии, что полученна€ прибыль оставалась на тор≠говом счету. ќчевидно, что при расчете R будут учтены все реинвести≠ции прибыли, совершенные управл€ющим. AMR равен усредненному за год максимальному мес€чному снижению стоимости активов (MR), где MR равна большей из следующих двух величин:

1. ћаксимальному снижению с момента предыдущего пика стоимо≠

сти активов (MRPP),

2. ћаксимальному снижению до последующего минимума стоимо≠

сти активов (MRSL).

ак подразумевает название, MRPP измер€ет, на сколько процентов снизились активы по сравнению с наивысшей их предыдущей точкой. ¬ результате дл€ данных в каждой точке (например, в конце мес€ца) MRPP отражает наихудшую переоценку, с которой теоретически мог бы столкнутьс€ любой инвестор, работающий со счетом в этот момент. MRPP равна совокупным потер€м, которые были бы зафиксированы инвестором, начинающим торговать в наихудший возможный предше≠ствующий момент времени (в момент наивысшей стоимости активов). «аметьте, что, если новый пик активов установлен в данном мес€це, MRPP дл€ этой точки будет равна нулю. ќдна из проблем, св€занных с MRPP, состоит в том, что дл€ начальных точек всего объема данных эта мера падени€ стоимости активов может быть недооценена, поскольку существует лишь малое количество предыдущих точек.

ак подразумевает название, MRSL измер€ет процентное снижение активов до последующей самой низкой точки. ¬ результате дл€ данных в каждой точке (например, на конец мес€ца) MRSL измер€ет наихуд≠шую переоценку, с которой в любой момент могли бы столкнутьс€ ин≠весторы, начинающие торговать в этом мес€це, т.е. совокупные поте≠ри, которые были бы зафиксированы подобными инвесторами в сле≠дующей точке минимальной стоимости активов. «аметьте, что если сто≠имость активов никогда не снижалась ниже уровн€ данного мес€ца, MRSL дл€ этой точки будет равна нулю. ќдна из проблем, св€занных с MRSL, состоит в том, что дл€ последних точек всего объема данных эта мера падени€ стоимости активов, скорее всего, будет недооценена, поскольку в последующих данных (при их наличии) мог бы содержать≠с€ новый минимум стоимости активов.

|

|

|

MRPP и MRSL дополн€ют друг друга. «аметьте, что их одновремен≠на€ недооценка маловеро€тна. ѕо этой причине, MR дл€ каждой точ≠ки определ€етс€ как набольша€ величина из MRPP и MRSL. ¬ этом смысле MR представл€ет действительно наихудший сценарий дл€ каж≠дой точки (например, дл€ конца мес€ца). AMR усредн€ет наихудшие

744 „ј—“№ 4. торговые системы и измерение эффективности торговли

возможные сценарии. Ётот подход значительно более основателен, чем методы, использующие лишь единственный наихудший случай Ч мак≠симальное снижение стоимости активов.

ћатематическое определение RRR дано ниже:

|

RRR= R

|

AMR

где R Ч средн€€ годова€ прибыль с учетом реинвестиций

(вывод смотри ниже);

|

|

где E, Ч стоимость активов на конец мес€ца i,

–≈, Ч пик стоимости активов в мес€ц i или до него, ≈, _! Ч стоимость активов на конец мес€ца,

предшествующего мес€цу i, ME, Ч минимум стоимости активов в мес€ц i или в следующий за ним мес€ц.

«аметьте, что MRPP, будет равной нулю дл€ первого мес€ца, а MRSL, будет равна нулю дл€ последнего мес€ца.

—редн€€ годова€ прибыль с учетом реинвестиции R выводитс€ сле≠дующим образом*:

—ледующий в примере вывод R, где R = 0,30, вз€т из статьи ƒж. Ўвагера ЂAlternative to Sharpe Ratio Better Measure of Performanceї, Futures, p. 58, March 1985.

|

|

|

| √Ћј¬ј 21. измерение результативности торговли 745 |

Ќапример, если счет в $100 000 вырос до $285 610 за четыре года, доходность в процентах годовых с учетом реинвестировани€ была бы равна 30%*:

¬ычисление RRR можно напр€мую применить к оценке результатив≠ности финансового управл€ющего, поскольку размер активов на счете известен дл€ каждой точки данных. ќднако минутное размышление об≠наружит, что в случае торговых систем размер активов неизвестен и дл€ каждого интервала доступно лишь отношение прибыли к потер€м. ак можно вычислить доходность, если мы не знаем какое количество ак≠тивов необходимо, чтобы торговать с помощью системы? ќтвет состо≠ит в том, что поскольку величина RRR не будет зависеть от размера активов, необходимых дл€ торговли с помощью системы*, может быть использована люба€ величина.

ѕример рабочего листа Excel дл€ вычислени€ RRR предложен в книге ЂSchwager on Futures: Managed Tradingї.

746 „ј—“№ 4. торговые системы и измерение эффективности торговли

’от€ это и не вли€ет на вычислени€, дл€ выбора правдоподобной величины трейдер может предположить, что активы, необходимые дл€ торговли с помощью системы, в четыре раза превышают максимальные убытки. Ќапример, если максимальный убыток системы составл€ет $50 000, дл€ торговли с помощью этой системы предположительно не≠обходимы активы, равные $200 000.

|

|

|

ак только размер активов, необходимых дл€ торговли с помощью системы (т.е. предполагаемый размер счета), выбран, мес€чные разме≠ры активов могут быть получены следующим образом:

1. ѕоделите все мес€чные значени€ прибылей/убытков на один и

тот же размер счета, чтобы получить мес€чные значени€ про≠

центной прибыли**.

2. »спользуйте цепь умножений подразумеваемого размера счета

на значени€ мес€чной процентной прибыли, чтобы получить ме≠

с€чные уровни активов. Ќапример, если предполагаемый раз≠

мер счета $200 000, а процентные прибыли за первые четыре

мес€ца составили +4, -2, -3 и +6%, тогда соответствующие

уровни активов вычисл€лись бы следующим образом:

Ќачало = $200 000.

онец мес€ца 1 = (200 000) (1,04) = $208 000.

онец мес€ца 2 = (200 000) (1,04) (0,98) = $203 840.

онец мес€ца 3 = (200 000) (1,04) (0,98) (0,97) = $197 725.

онец мес€ца 4 = (200 000) (1,04) (0,98) (0,97) (1,06) = $209 588.

огда получены мес€чные уровни активов, вывод значений R и AMR дл€ вычислени€ RRR будет в точности аналогичен случаю оценки фи≠нансового управл€ющего.

—ледует заметить, что в реальной торговле каждый корректировал бы используемые дл€ торговли активы, основыва€сь на личных взгл€-

ѕоскольку предполагаемый размер активов используетс€ как делитель и в числителе, и в знаменателе RRR, он будет сокращен. Ќапример, удвоение раз≠мера предполагаемого счета сокращало бы наполовину как среднюю годовую прибыль с учетом реинвестиций, так и усредненное за год максимальное сни≠жение стоимости активов, оставл€€ значение RRR неизменным.

ќбратите внимание на то, что торговые результаты системы основывают≠с€ на фиксированном портфеле. ƒругими словами, при тестировании систе≠мы количество контрактов не увеличиваетс€, когда система зарабатывает день≠ги, и не уменьшаетс€, когда система терпит убытки. (¬ действительной торгов≠ле, конечно, такие поправки были бы сделаны.) “аким образом, использова≠ние посто€нного размера счета в качестве делител€ при переводе отношени€ прибыль/убытки в процент прибыли €вл€етс€ допустимой процедурой.

√Ћј¬ј 21. измерение результативности торговли 747

дах на риск. ƒействительный используемый уровень мог бы быть боль≠ше или меньше, чем четырехкратный размер максимальных потерь, ко≠торый мы использовали как начальное предположение при вычислении RRR дл€ системы. ќднако на значении RRR системы никак не сказы≠валс€ бы определенный выбор размера счета, рассматриваемого как необходимый дл€ торговли с помощью системы.

√ќƒќ¬ќ≈ ќ“ЌќЎ≈Ќ»≈ ѕ–»ЅџЋ№/”Ѕџ“ » (GAIN TO PAIN)

√одовое отношение ѕрибыль/”бытки (AGRP) представл€ет собой уп≠рошенный вариант вычислени€ отношени€ RRR. AGRP определ€етс€ следующим образом:

AGRP = AAR/AAMR,

где AAR Ч среднее арифметическое годовых прибылей, AAMR Ч среднее значение максимальных годовых па≠дений стоимости активов, где падение стоимо≠сти активов дл€ каждого года определ€ютс€ как процентное падение от предшествующего максимума активов (даже если он по€вилс€ в предыдущий год) до минимума активов этого года.

RRR лучше измер€ет риск, чем AGPR, поскольку при вычислении рис≠ка учитываютс€ данные в каждой точке, и вычисление не ограничива≠ет данные искусственно (например, отрезками календарных годов). “ем не менее, некоторые трейдеры могут предпочесть AGRP, посколь≠ку он требует меньших вычислений, и полученное в результате число обладает интуитивно пон€тным значением. Ќапример, AGRP, равный 3, означал бы, что средн€€ годова€ прибыль в три раза больше, чем средн€€ годична€ отрицательна€ переоценка (измеренна€ от предыду≠щего пика).